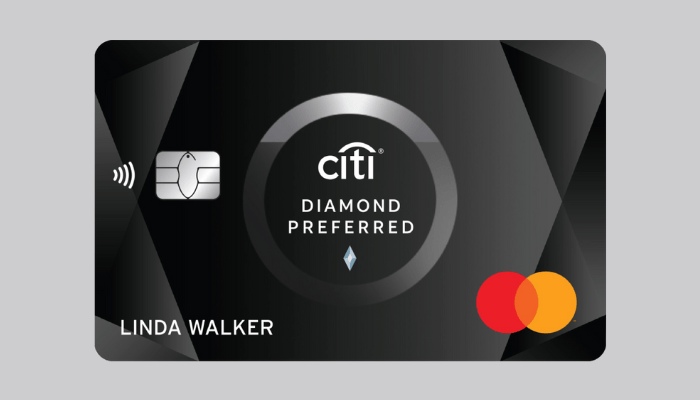

See the main benefits, exclusivity and privileges of the Citi Diamond Card

In this scenario, the Citi Diamond Card stands out as an option full of privileges, meticulously designed to meet the expectations of the most demanding consumers. With a value proposition that transcends the conventional, this card not only facilitates transactions, but also opens doors to an enriching life experience, marked by benefits and conveniences that only an institution with the reputation and solidity of Citi could offer.

Furthermore, exclusivity is present not only in services, but also in personalized service and the range of unique experiences available to Citi Diamond Card holders.

With an unbeatable combination of advantages, which includes everything from differentiated insurance to rewards programs that reward each purchase, this card is positioned as a smart choice for those who value not only quality and security in their financial transactions, but also the possibility of accessing a universe of privileges that go beyond the material.

Deixe um comentário