Wells Fargo Autograph Card – Get 3X Unlimited Points Benefit Now

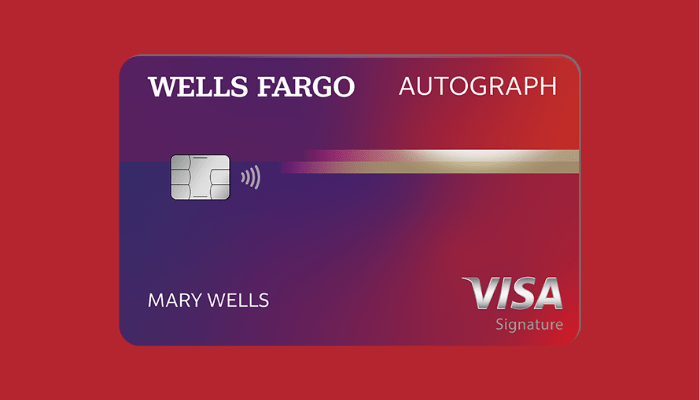

In the world of personal finance, choosing the ideal credit card makes all the difference. This is where the Wells Fargo Autograph Card comes in, a true gem for those looking to maximize rewards. Standing out with its benefit of 3X unlimited points on varied purchases, this card turns everyday life into an opportunity to accumulate valuable points.

So, we invite you to explore the Wells Fargo Autograph Card in more depth. Find out how this card not only stands out, but also how to make the most of your unlimited 3X points.

Whether planning your next big trip or optimizing routine purchases, understanding this card can be the first step to enriching your financial journey. Come and discover how it can become your great financial ally.

What does wells fargo autographsm card

In the current landscape of financial solutions, the Wells Fargo AutographSM Autograph Card emerges as a prime tool for rewards aficionados. With it, each purchase becomes an opportunity to maximize returns, raising the standard of benefits on credit cards.

When entering the universe of this card, users unlock a spectrum of benefits, from travel bonuses to unparalleled flexibility in everyday purchases.

Thus, it is established as the preferred choice for those who wish not only to manage their finances masterfully, but also to expand their consumption horizons in an intelligent and strategic way.

How to request a Wells Fargo Autograph card

Discovering how to apply for the Wells Fargo Autograph Card is the first step to unlocking a world of rewards and benefits. This process, optimized for user convenience, opens the doors to unlimited points earnings and unique experiences. Being part of this exclusive universe is simpler than it seems, requiring just a few strategic steps.

To embark on this journey, follow this practical itinerary:

- Visit the Official Website : creditcards.wellsfargo.com

- Search for the AutographSM Card : Find the specific Wells Fargo Autograph Card option and click “Request Now”.

- Complete the Form : Enter your personal and financial information as requested. This includes data such as name, address, annual income and social security number.

- Review and Submit : Before submitting your request, please review all information to ensure its accuracy. After confirming, submit your application.

- Wait for Approval : Generally, the approval process is quick. You will receive a response shortly informing you of the status of your request.

By following these steps, you’ll be one step closer to enjoying everything the Wells Fargo Autograph Card has to offer.

What are the pre-approval requirements?

Navigating the Wells Fargo Autograph Card pre-approval process requires a clear understanding of the essential criteria. These requirements not only reflect your financial strength but also determine your eligibility to benefit from the exclusive rewards and perks offered. Notable among them are the need for a robust credit score and a consistent financial history.

Reviewing these documents, along with checking your credit score, forms the basis for your pre-approval decision. By meeting these criteria, Wells Fargo Autograph Card aspirants can move forward confidently in the process, anticipating a positive response that will open the doors to an expanded range of benefits and rewards.

What are the additional features and benefits of the card?

Exploring the additional features and benefits of the Wells Fargo Autograph Card reveals a universe of benefits designed to enrich your financial experience. In addition to the attractive accumulation of points, this card stands out for offering a series of exclusive protections and services.

Notable benefits include:

- Cell Phone Protection

- Collision Damage Waiver for Car Rental:

- Travel Assistance and Emergency Services

- Road Dispatch

- Emergency Cash Disbursement and Card Replacement

- My Wells Fargo Offers

- Zero Liability Protection

- Credit Club

Each of these features has been carefully designed to meet the needs of Wells Fargo Autograph Cardholders, ensuring a safe, convenient and rewarding financial journey.

Is Wells Fargo autograph hard to get?

This selectivity ensures that only candidates with financial strength and an exemplary credit history can enjoy its numerous benefits, thus raising the standard of quality and security for everyone involved.

Moving forward, it is important to recognize that although accessing the Wells Fargo Autograph Card requires specific qualifications, the process is transparent and guided by objective criteria. For those interested, the key to success lies in adequate preparation and maintaining a solid credit profile.

Earn up to 3X unlimited points

This exclusive offer not only captivates users with the ability to maximize their rewards on every transaction, but also reinforces the card’s commitment to delivering exceptional value.

Tailored to meet the needs of modern consumers, this benefit takes the card usage experience to new heights.

To make the most of this benefit, follow the steps below:

- Apply for the Card : First, become a Wells Fargo Autograph Cardholder by fulfilling the pre-approval requirements.

- Make Qualifying Purchases : Use your card on shopping categories that qualify for earning 3X points, such as travel, dining and streaming services.

- See Terms : Familiarize yourself with the terms and conditions to fully understand which transactions qualify for the 3X points benefit.

- Track Your Points : Monitor your earnings through the Wells Fargo online portal or mobile app, ensuring you are maximizing your reward potential.

- Redeem Wisely : Explore redemption options that maximize the value of your points, whether through travel, purchases or conversion into statement credit.

By following these steps, you’ll be on your way to optimizing your rewards and making the most of the 3X unlimited points benefit that the Wells Fargo Autograph Card offers.

How will you redeem your reward points?

The answer lies in understanding the various redemption options available, ranging from travel to bill credits, each offering a unique potential for increasing the value of your points.

As a result, the points redemption process is simplified and accessible, ensuring that you can enjoy the fruits of your efforts without complications. First, access your account online or through the Wells Fargo mobile app to view your points balance.

Then explore redemption options, which include flights, hotel stays, merchandise, and even exclusive experiences. By choosing the option that best aligns with your interests and goals, you maximize the return on your expenses, transforming each purchase into a valuable opportunity.

How to Download Autograph Card App

For Wells Fargo Autograph Cardholders, downloading the corresponding application is the first step to enjoying simplified and secure financial management. This process not only brings users closer to their finances, but also optimizes the user experience by offering instant access to exclusive features and benefits.

To download the Wells Fargo Autograph Card app, follow these steps:

- Visit the App Store : Open the Google Play Store or Apple App Store on your mobile device.

- Search for the App : Type “Wells Fargo Mobile” in the search bar to find the official app.

- Select and Download : Locate the app in the search results and select “Install” or “Get” to start the download.

- Open and Access : After installation, open the app and log in with your Wells Fargo account credentials or register if this is your first time accessing.

- Explore Features : Browse the app to discover all the functionality available to Wells Fargo Autograph Cardholders, including viewing balance, paying bills, tracking rewards and more.

By following these simple steps, you’ll be ready to enjoy the convenience and benefits of managing your Wells Fargo Autograph Card right from your smartphone.

Deixe um comentário