How to Apply for the Wells Fargo 2% Cash Back Credit Card

The Wells Fargo 2% Cash Back Credit Card , also known as the Wells Fargo 2 Cash Back Card , has become one of the most sought-after rewards cards in the United States. It offers a fixed 2% cash back on all eligible purchases, allowing every spend to be converted into real financial benefits, without complex limitations or rotating categories.

For those who already have the card, understanding how to request and manage Wells Fargo 2 Cash Back cashback through the official website or app is essential to maximize the program’s potential. This process is simple, secure, and ensures the cardholder has full control over the accumulated funds, redeeming them in the most strategic way possible.

Throughout this guide, you’ll discover in a clear and practical way how to use it to transform everyday expenses into consistent rewards. The content subtly invites you to explore every detail of the program and adopt strategies that boost your financial results.

See Now How to Request Wells Fargo Cashback 2

By understanding each step of the process, cardholders can transform ordinary purchases into immediate financial returns, using the bank’s digital platforms to manage their rewards in a practical and strategic way. This approach elevates the customer experience to a more sophisticated and profitable level.

Step by step guide to requesting cashback from Wells Fargo 2 Cash Back (with link):

- Access the official Wells Fargo portal: wellsfargo.com and log in with your credentials.

- In the “Rewards” or “Cash Back” menu, check the balance available for redemption.

- Select the desired redemption option: statement credit, account deposit, or bank transfer.

- Confirm the data and complete the request so that the amount is credited according to your choice.

With this detailed step-by-step guide and a direct link to the official website, you can ensure a transparent and secure process for converting your rewards into real value with the Wells Fargo 2 Cash Back Card .

Is cashback a trap?

Cashback, while seemingly a mere immediate financial benefit, can become a trap for unwary consumers. Programs like the Wells Fargo 2% Cash Back Credit Card encourage recurring spending, and without careful planning, users may end up spending more than they should to accumulate rewards.

Therefore, it is crucial to understand the limits and conditions of each rewards program before using it intensively.

By carefully analyzing the rates, terms, and spending categories of the Wells Fargo 2 Cash Back Card , the cardholder can enjoy cashback as a strategic resource, without falling into the trap of excessive consumption, transforming the benefit into a true ally in strengthening personal finances.

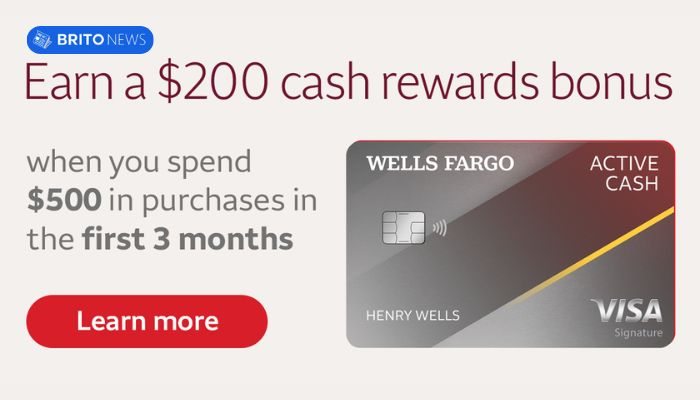

How do I get a $200 cash bonus from Wells Fargo?

This bonus is granted as an incentive to new customers: by meeting a certain spending limit within a stipulated timeframe, the user receives this direct benefit as a reward. Understanding each condition is essential to ensure you actually receive the advertised amount without any surprises.

Step by step to receive the $200 bonus:

- Apply for the Wells Fargo Active Cash Credit Card through the official Wells Fargo website.

- Make up to $500 in qualifying purchases within 3 months of approval. ( creditcards.wellsfargo.com )

- Check your statement or rewards section to see if the $200 bonus has been credited after meeting the requirement. ( wallethub.com )

By strictly following these steps, you’ll not only guarantee receipt of the $200 promotional bonus, but you’ll also transform the Wells Fargo Active Cash Credit Card into a strategic tool for strengthening your personal finances, optimizing your daily spending, and making the most of every benefit offered by the rewards program.

What is Wells Fargo’s 6-month rule?

Wells Fargo ‘s 6-month rule states that you may not be eligible to apply for another Wells Fargo credit card if you’ve already opened one within the last six months.

This measure acts as a frequency restriction on applications, and is frequently mentioned in the terms and conditions of the brand’s cards.

In other words, if you’ve recently activated or applied for a Wells Fargo 2 Cash Back Card or any other Wells Fargo card, it’s recommended to wait this period before submitting a new application — this way, you’ll avoid automatic denials and keep your credit history healthier.

How much are 60,000 Wells Fargo points worth?

Considering that each point typically equals 1 cent when redeemed for credit or cashback, 60,000 points is worth approximately $600 . This estimate follows the Wells Fargo Rewards program standard, which sets this base value for most redemption methods. ( wellsfargo.com )

Estimated value for 60,000 Wells Fargo points:

- Credit or cashback: US$600

- Gift cards: ≈ US$ 600

- Travel reservation via portal: ≈ US$ 600

- Transfer to travel partners (amount may vary): potentially more than US$600

With this equivalence, cardholders can strategically plan their points use, choosing the most advantageous redemption method for their financial profile. By analyzing the available options, they can transform the 60,000 Wells Fargo Rewards points into real benefits, maximizing the return on every dollar spent.

Extra card benefits

The card offers additional benefits such as cell phone protection, credit monitoring, anti-fraud security, and easy access to digital financial management platforms. This combination elevates the product to a higher level in the rewards market.

By fully understanding and utilizing these additional benefits, the Wells Fargo 2 Cash Back Card becomes a strategic tool for optimizing spending and protecting your assets.

With exclusive resources and specialized support, each transaction becomes not just a purchase, but a smart step towards a more robust and personalized financial experience.

Deixe um comentário