How to Increase Your Capital One Venture Credit Card Limit

Who hasn’t dreamed of having that credit card limit that offers freedom to plan that special trip or handle an emergency without difficulty? Credit cards have ceased to be just a payment method and have become a true partner in personal finance management.

Achieving a higher limit on your Capital One Venture isn’t just about spending more; it’s about having more financial flexibility, more security for unforeseen events, and a more powerful tool for organizing your budget.

We will unveil the practices, timeframes, and foolproof tips so you can achieve, once and for all, the limit that your Capital One Venture can offer, transforming your relationship with the bank into a partnership of mutual trust.

How to Request a Capital One Venture Card Limit Increase?

The most modern, fast, and efficient way to request a limit increase for your Capital One Venture is using the institution’s official digital platform. The app, available for smartphones, offers a simplified user experience, ensuring security and agility in the process.

The request process is transparent and can be done in a few minutes, directly in the palm of your hand. Here’s a detailed and practical step-by-step guide for you:

- Download and Access the Official App: Make sure you have the latest version of the Capital One app installed on your phone and log in with your credentials.

- Select the Card: On the main screen, locate the Capital One Venture card for which you want the limit increase.

- Access Card Options: Look for a settings menu, usually identified as “Services,” “Manage Card,” or “Credit Limit.”

- Locate the Increase Option: Click on “Request Limit Increase” or similar option that initiates the credit analysis process.

- Update Your Income: The system will ask you to confirm or update your monthly income. It’s vital to be honest and accurate here, as income is one of the decisive factors.

- Enter Desired Amount (if requested): In some interfaces, you can suggest a new limit. Choose an amount that’s realistic for your current income.

- Confirm and Submit Request: Review the information and finalize the request. Analysis may be instant or take a few days.

Remember: although the process is digital and fast, approval is a direct result of your previous behavior. Good usage practices, like those we’ll see next, are the main shortcut to accelerating the bank’s positive response.

Understanding the Capital One Venture Card Limit

If you’re searching for “how to get a limit on Capital One Venture” or “increase my card limit easily,” you first need to understand how the financial institution defines this value. When you apply for the card for the first time, the bank performs a complete risk analysis.

The initial limit is a combination of several key factors, such as your proven income, your credit history (the famous score), your previous relationship with the bank, and your payment capacity. They need to feel confident that you’ll be able to honor the commitment.

It’s crucial to know that your Capital One Venture card limit is not a final sentence. On the contrary, it’s a dynamic value. The bank is always watching your credit behavior. If you use the card regularly, pay bills on time, and maintain a good score, the system understands that your risk profile is low.

Good Practices to Increase Your Limit

The key for the bank to release more credit on your Capital One Venture is building a trust relationship. The bank needs to see you as a responsible customer capable of managing larger amounts. This is what we call “smart credit use.”

To show Capital One that you’re the ideal customer for a limit increase, adopt these seven golden practices:

- Always Pay the Invoice On Time: This is the golden rule. Delays, even small ones, tarnish your image as a good payer. Paying the invoice in full by the due date is fundamental.

- Use the Card Frequently: It’s no use keeping the card stored away. Use Capital One Venture as your main payment method. The bank likes to see that the granted limit is being used.

- Keep Your Credit Score High: Pay all your bills on time (electricity, water, phone, other credits). A high score shows responsibility with the financial market as a whole.

- Avoid Maximum Use (30% Factor): Try to use at most 30% of your total limit. If your limit is $1,000, try not to exceed $300. This indicates you have financial breathing room.

- Keep Your Income Updated: Whenever your income increases (promotion, new job, etc.), update this information in the bank’s app. It’s a powerful argument for an increase.

- Diversify Card Use: Use it for different types of purchases, such as online shopping, supermarket, and even installments. This demonstrates it’s a central instrument in your financial life.

- Use Other Bank Services: If possible, use other Capital One products or services, such as checking account, investments, or insurance. This strengthens your relationship with the institution.

Adopting these attitudes not only helps achieve a higher limit but also strengthens your relationship with the bank, making you a valuable and priority customer for special offers and conditions.

How Long Does It Take to Increase the Limit?

If you search for “timeframe to increase Capital One Venture limit,” you’ll discover there’s no single answer, but rather an average. The time it takes for you to get a limit increase, whether by manual or automatic request, generally ranges around 3 to 6 months of good use and behavior.

It’s important to note that this timeframe can vary considerably from person to person. A customer with an already excellent credit profile and high income may get a faster increase, perhaps in 90 days.

On the other hand, if you just cleared your name or have a median score, the bank may take the full six months or even a bit more to feel completely secure.

What Is the Maximum Capital One Venture Card Limit?

It’s very common, but the truth is there’s no fixed and rigid maximum value for your card. Unlike some products with a strict ceiling, the Capital One Venture limit is designed to grow along with your purchasing power and credibility in the market.

The limit can be $5,000 for one customer and $50,000 for another. This value is the financial representation of how much the bank trusts you.

The maximum limit you can achieve is influenced by a series of variables that form your profile. For you to understand how the bank calculates this potential, check out the key factors that influence your maximum limit:

- Proven Income: The greater your earning capacity, the greater the potential limit.

- Payment History: Never having had delays in any type of credit.

- Credit Score (Very High): Scores above 800-900 are ideal.

- Credit Line Utilization: Not using the full limit, keeping utilization rate low.

- Consolidated Relationship: Having an account or other products at Capital One for a long time.

- Absence of Debts: Not having large active loans or financing.

- Registration Update: Keeping all your information (address, phone, income) always up to date.

Therefore, your Capital One Venture card’s maximum limit is not a number, it’s a direct reflection of your financial credibility. Continue with conscious use, and your limit will continue to expand, honoring the trust you’ve built with the institution.

Can I Request a Limit Increase at Any Time?

The app or customer service will likely allow you to initiate the process whenever you feel the need. However, the key point is not the possibility of asking, but rather the probability of being approved.

Making an unprepared request can result in a denial, and receiving frequent denials can even signal to the bank that you’re desperate for credit, which is not a good indicator.

Ideally, you should only request an increase when you know you have a good recent history and the timing is right. The best behavior is to wait for the minimum period suggested by the bank (usually 3 to 6 months since the last increase or request) and only then ask.

Understand the reason, work to correct it (such as paying off a debt), and maintain good card use. Try again after three months of exemplary behavior. Strategic persistence, based on good practices, always wins in the end.

Is the Limit Increase Automatic?

If the risk management software identifies that you’ve been using a high percentage of your limit (but without exceeding the ideal 30%-50%), always paying invoices on time and with your score rising, it may understand it’s time to grant an increase proactively, as a “gift” for your good financial management.

Automatic increase is proof that you’re a valuable and low-risk customer. To maximize your chances of receiving this increase without lifting a finger, follow these seven essential steps:

- Use the Card Regularly: Make it your main payment method for everyday expenses.

- Keep Your Mailing Address Updated: A stable address signals financial stability.

- Update Your Income in the App: If your income grew, the bank needs to know this to reassess your limit.

- Make Full Invoice Payments: Avoid revolving credit as much as possible, always paying the full amount.

- Use the Card Close to Due Date: Paying the invoice soon after closing but before due date can be well viewed.

- Pay via Automatic Debit: This ensures punctuality and eliminates forgetting risk.

- Explore Reward Programs: Using card benefits (miles, cashback) shows you’re engaged with the product.

When the increase is automatic, it usually arrives via app notification or email, simply and immediately.

Is it hard to get a Capital One Venture card?

Approval tends to be more selective, as the institution requires a solid financial profile, high score, and consistent credit history. This rigorous analysis ensures the card is offered to consumers with greater stability and payment capacity.

Continuing the explanation, those with proven income, good financial behavior, and low debt ratio tend to have better approval chances.

The process isn’t impossible, but demands responsibility and preparation, reinforcing the importance of maintaining a healthy credit profile before applying for Capital One Venture.

My Request Was Denied, What Now?

A denial on your Capital One Venture limit increase request can be frustrating, but it’s essential to understand it’s not definitive.

Don’t see it as rejection, but rather as feedback from the bank about what needs adjusting in your credit profile. Often, denial occurs for simple and perfectly correctable reasons.

The most common reasons for the bank to deny your request include:

- Low Recent Use: You haven’t used the card enough in recent months to justify an increase.

- Maximum Utilization: You’re using almost 100% of current limit, signaling you may not be able to manage a larger amount.

- Delay on Other Accounts: Your score dropped due to late payment on another account or loan.

- Too Many Credit Inquiries: You requested credit at many institutions in a short period, which signals risk.

The best attitude after a denial is to stay calm and follow the plan. Continue with conscious use of your Capital One Venture and other credit lines, paying everything on time and clearing any pending issues that may have arisen.

What are the disadvantages of Capital One Venture?

Among the main points cited by users are the relatively high annual fee, stricter credit requirements, and the need to maintain strategic use to really maximize rewards. These factors can limit access for beginner profiles in the credit market.

Continuing the analysis, some people consider that miles value can vary according to the program used, requiring attention when redeeming benefits.

Still, these disadvantages don’t negate the card’s potential, but reinforce the importance of evaluating your financial profile before applying for Capital One Venture.

Does Having Bad Credit Prevent the Increase?

The reason is simple: a restricted name in credit protection agencies like Serasa and SPC is the greatest indicator of high risk for any financial institution. The bank understands that if you couldn’t honor past commitments, the chances of you not being able to pay a higher limit are elevated.

Restricted CPF harms limit increase for at least seven crucial reasons:

- Immediate Increase in Default Risk: The bank sees bad credit as a sign the debt may repeat.

- Severe Credit Score Drop: The score is the market’s thermometer and negative listing drastically lowers it.

- Income Commitment: The bank assumes part of your income is committed to paying overdue debt.

- Bad Payer History: The stain on history is difficult to erase quickly.

- Lack of Credibility: Restriction diminishes your credibility for all credit operations in the market.

- Institution Disinterest: The bank focuses on low-risk customers, and the negative-listed becomes high-risk.

- Collateral Requirements: For any credit, the bank may start requiring guarantees, not just trust.

Therefore, before thinking about “how to increase Capital One Venture limit with bad credit,” focus on the priority task: negotiate and pay off your debts to clear your name. Only after that, start building the necessary good history.

How Many Times Can I Request an Increase?

The frequency with which you can manually request a limit increase for your Capital One Venture varies, but the market rule and most institutions’ recommendation is, on average, every 3 to 6 months.

This is the time interval necessary for your financial behavior to change enough to justify a new analysis and, potentially, a different result from the previous one. Asking every month, for example, is ineffective and can be poorly viewed by the analysis system.

The key to success isn’t in frequency, but in request quality. Ensure that in the 3 to 6 month period since the last attempt, you’ve practiced the mentioned “good practices”: frequent use, on-time payments, and high score. A manual request should always be a strategic act, not a desperate one.

How to Apply for the Capital One Venture Card?

If you don’t have your card yet and want to know “how to get the Capital One Venture card,” the process is entirely digital, fast, and designed to be intuitive and secure. The institution uses an intelligent analysis system that evaluates your credit profile in minutes, giving a quick response.

Here’s a clear step-by-step guide to apply for your card:

- Access the Official Website or App: Go directly to Capital One’s digital channel (www.capitalone.com).

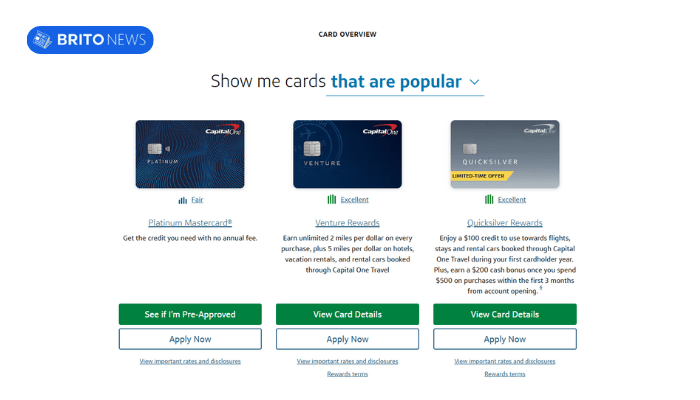

- Find the Cards Option: Navigate to the products section and select Capital One Venture.

- Fill Out the Application Form: Click “Apply for Card” or “Apply Now” and start filling in your personal data (name, CPF, address, email).

- Enter Your Income and Occupation: Declare your monthly income and professional situation. Be honest to ensure fair analysis.

- Send Documents (if requested): In some cases, it may be necessary to send a photo of your ID or proof of residence through the app itself.

- Confirm and Wait for Analysis: Review information, accept terms of use, and finalize the application. Analysis is usually quick.

- Track Status: You’ll receive a protocol number to track your application progress via email or app.

By having your Capital One Venture, you’ll have access to exclusive benefits, such as travel rewards programs, miles, and cashback. Apply today and start building your financial future with a high-level card.

Is it worth investing in Capital One Venture One?

For many consumers, the answer is yes, especially for those seeking a card with excellent cost-benefit, relevant rewards, and robust financial structure. It offers generous points, advanced security, and a practical and intuitive usage experience.

Continuing this evaluation, Capital One Venture One stands out for travel flexibility, continuous miles accumulation, and institution credibility.

The card becomes even more advantageous for those who want to maximize purchasing power, use premium benefits, and maintain intelligent long-term financial management.

How to Contact the Card Operator?

Keeping communication channels with your Capital One Venture operator always at hand is essential to resolve doubts, dispute transactions, or, of course, make your manual limit increase request. The institution offers a variety of channels to ensure you have support whenever you need it.

For your security and convenience, the main service channels are:

- Official App: Chat and help section within the app are the fastest means for operational questions and requests like limit increases.

- Telephone Service Center: There are specific numbers for customer service and for loss or theft cases (available on the back of your card and on the website).

- Official Website (Home Banking): The customer’s logged-in area on the website offers support via secure messages.

- Support Email: Specific channels for sending documents or formal contact, usually provided on the website itself.

- Physical Branches (if available): For more complex issues or those requiring physical presence, you can seek a unit.

Always use Capital One’s official communication channels. Never provide passwords or personal data on suspicious links or emails. Your information security is the best way to avoid fraud and ensure your credit management is smooth and effective. You’re in control of your finances!

Deixe um comentário